Self-care is not an event — it’s a process. For many of us, keeping regular routines is the most sustainable way to ensure we stay feeling our best. When life gets stressful, visits to our favorite hair stylist or a workout class allow us to feel joyful and decompress.

When it comes to beauty, fitness, and wellness, you can find a plethora of products and services to invest in. So StyleSeat is dedicated to helping beauty clients find the very best, but we also know everyone’s budget and routine look different.

We recently surveyed over 1,400 people to see what those spending habits and routines actually look like for Americans. Then we checked out how those routines change when factoring in elements such as inflation or a pandemic.

Key Findings

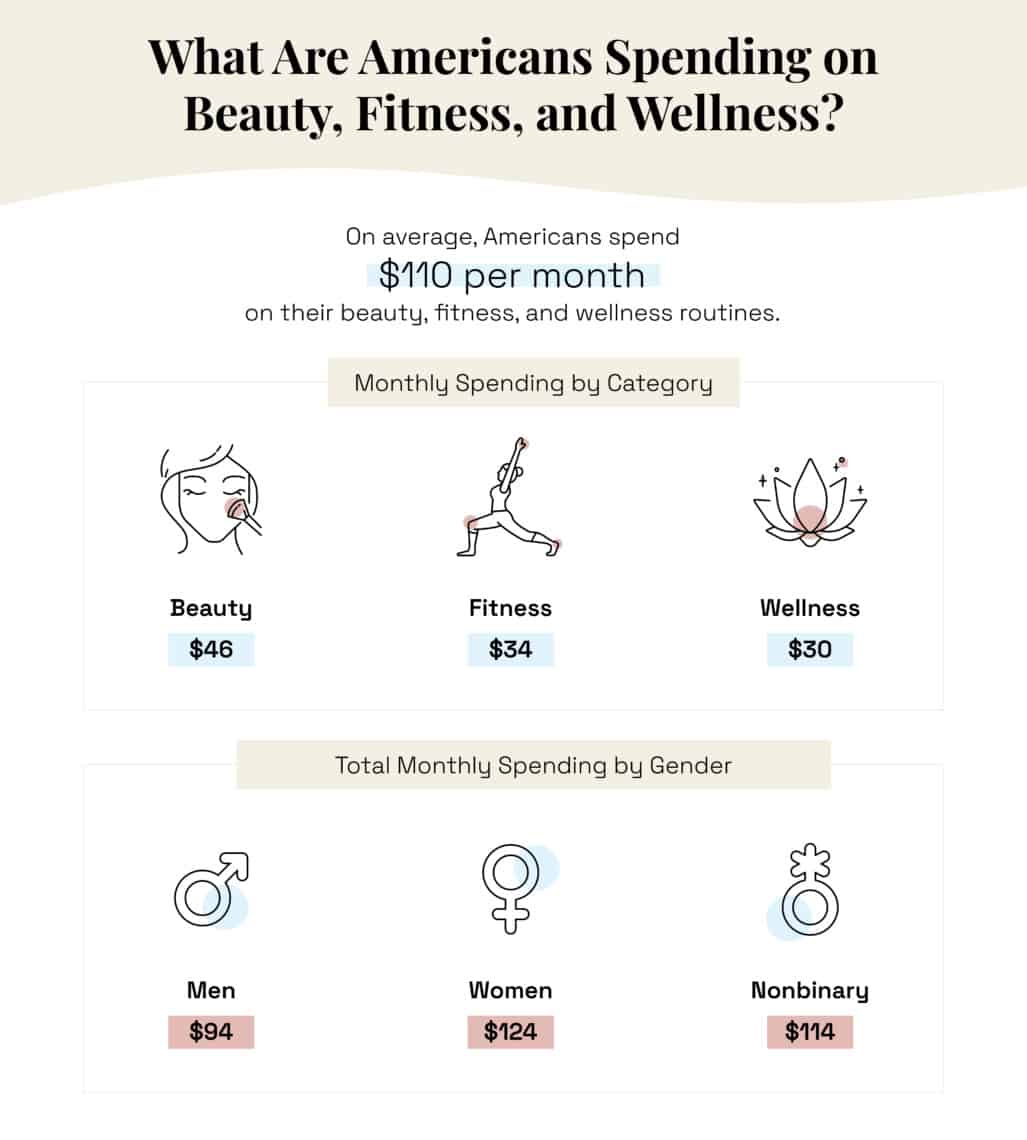

- Americans spend an average of $110 a month on beauty, fitness, and wellness.

- Of these categories, Americans spend the most on three things: vitamins and supplements, haircuts, and skin care.

- Of all respondents, 60 percent know someone who spends more money on beauty, fitness, and wellness than they can afford.

- Although respondents expect beauty spending to decrease this year, they expect fitness and wellness spending to increase. In fact, 71 percent of respondents do not plan to cut back on wellness spending despite inflation.

Beauty, fitness, and wellness spending habits

We wanted to better understand how Americans choose to spend their money on self-care routines. So, in our survey, we asked respondents to tell us how much they spent on beauty, fitness, and wellness. The following list provides some examples of the kinds of products and services in each category:

- Beauty: Hair, skin, makeup, nail, hair removal, teeth whitening

- Fitness: Gym memberships, studio classes, workout equipment, fitness apparel, vitamins and supplements

- Wellness: Mental health services, sleep aids, meditation tools, bodywork

While the average respondent spent $110 a month on these categories, they didn’t distribute their spending equally across all categories. Instead, Americans spent the most on beauty ($46), followed by fitness ($34), with the lowest monthly investment in wellness ($30). Women and nonbinary individuals also spent more ($124 and $114, respectively) than men ($94) in these categories overall.

The millennial respondents spent the most of any generation at $115 per month. Millennials spent $20 more monthly on beauty, fitness, and wellness than members of Gen Z, amounting to a $240 annual difference.

The biggest beauty, fitness, and wellness expenses

We also asked respondents to rank the products and services they spend the most on in each category.

Haircuts and facial skin care were tied for the biggest beauty expenses. Nearly 1 in 4 (23 percent) said they spent the most on haircuts, while another 23 percent spent the most on facial skin care.

Vitamins and supplements were two times more popular than any other fitness expense with nearly 2 in 5 (36 percent) saying they spent the most on them. Sleep aids and mental health care (both 19 percent) tied for the biggest wellness expenses.

All these expenses can add up, and 60 percent of Americans know someone who spends more money than they can reasonably afford on their beauty, fitness, and wellness routines. This number is even higher when looking at Gen Z respondents (70 percent) and women (66 percent). Knowing ahead of time what certain services cost can help you stay on budget, while still feeling pampered.

Beauty is the largest spending category

Our survey provided some insight into what Americans invest in most across beauty, fitness, and wellness categories, and where they get the most bang for their buck.

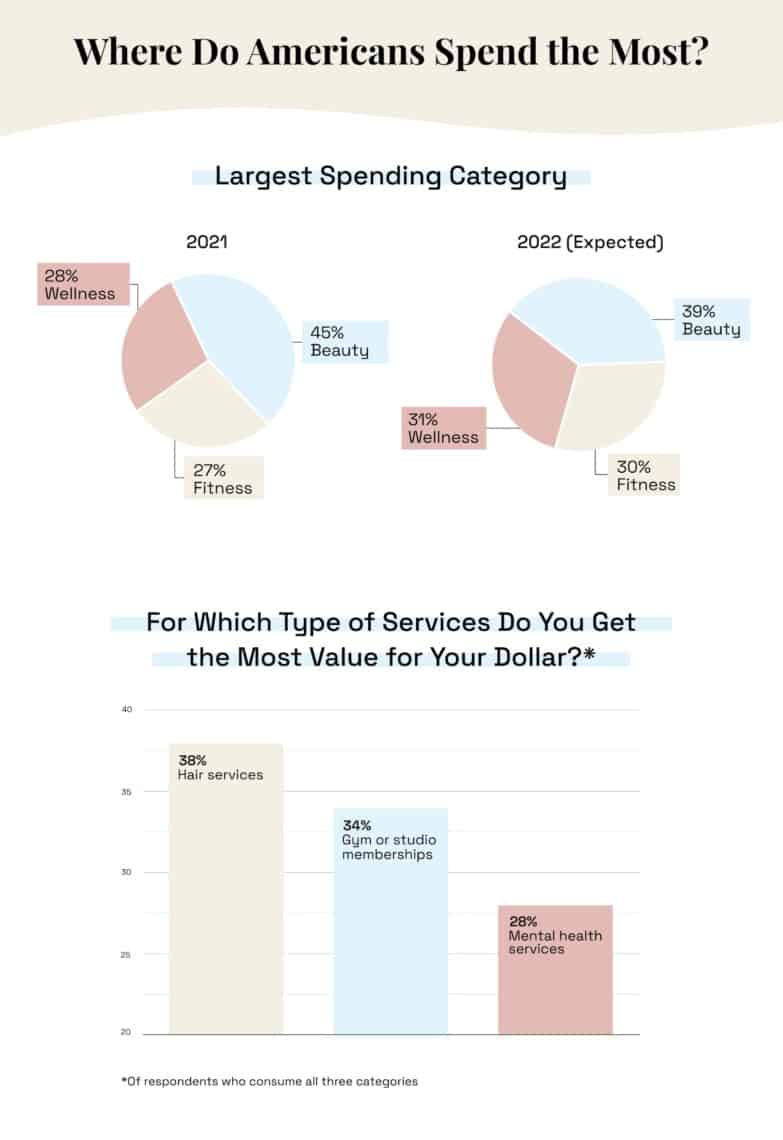

Respondents expected beauty to remain the largest spending category in self-care this year with nearly 2 in 5 (39 percent) saying they will spend the most on it. However, this is down from last year, when 45 percent said beauty was their largest spending category.

Instead, respondents are spending more on the fitness and wellness categories. Of all respondents, 1 in 3 indicated that fitness will be their largest spending category this year, an increase of 3 percent from last year. We see the same trend with wellness, which increased from 28 percent to 31 percent.

We then asked respondents to rate which popular service allows them to get the most value for their dollar: hair services, gym or studio memberships, or mental health services. Of respondents who use all three, 38 percent said hair services were most valuable, 34 percent chose gym or studio memberships, and 28 percent chose mental health services.

The majority of Americans will not cut beauty, fitness, and wellness spending, despite inflation

As we navigate a pandemic and inflation, many of us are making changes to our normal routines. We asked respondents what this looks like for their beauty, fitness, and wellness practices.

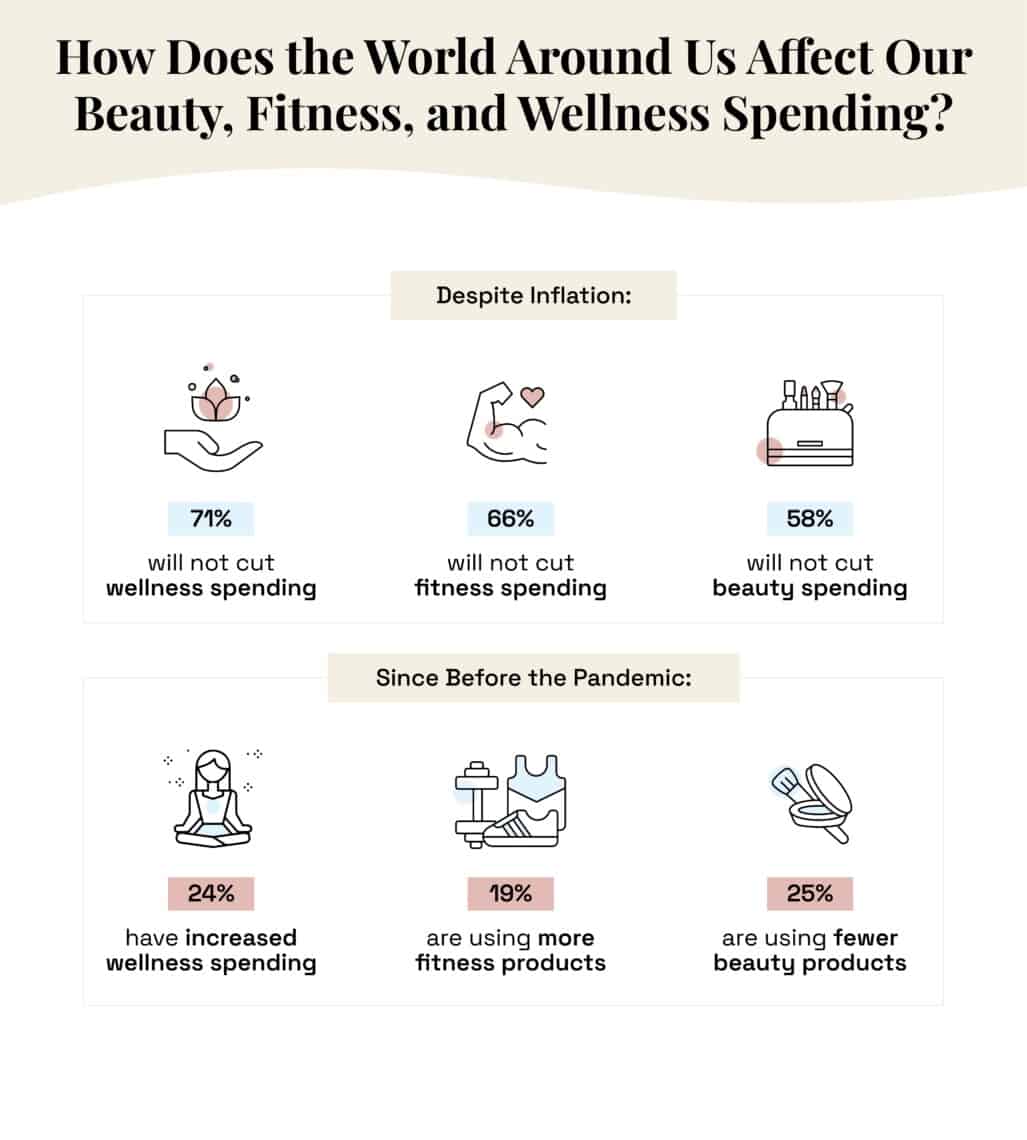

Despite inflation, the majority of Americans indicated they will not cut spending on beauty, fitness, or wellness. In fact, 71 percent indicated consistent or increased spending on wellness, while 66 percent said the same for fitness and 58 percent for beauty.

The world before COVID-19 looked quite different when it came to beauty, fitness, and wellness. In the last couple of years, about one in four Americans have increased their spending on wellness. Nearly one in five indicated they are using more fitness products, and one in four Americans are using fewer beauty products overall.

In an unpredictable world, Americans continue to find solace in our self-care routines. With limited time and resources, a little bit of research can go a long way in finding the services that work best for you. StyleSeat empowers clients to connect with experienced, talented Pros who can become trusted fixtures in their beauty routines.

Methodology: From April 15 to April 18, 2022, we surveyed 1,421 Americans on what they buy to maintain their beauty, fitness, and wellness routines. 46 percent identified as women, 46 percent identified as men, and 8 percent identified as nonbinary. The average age was 37.